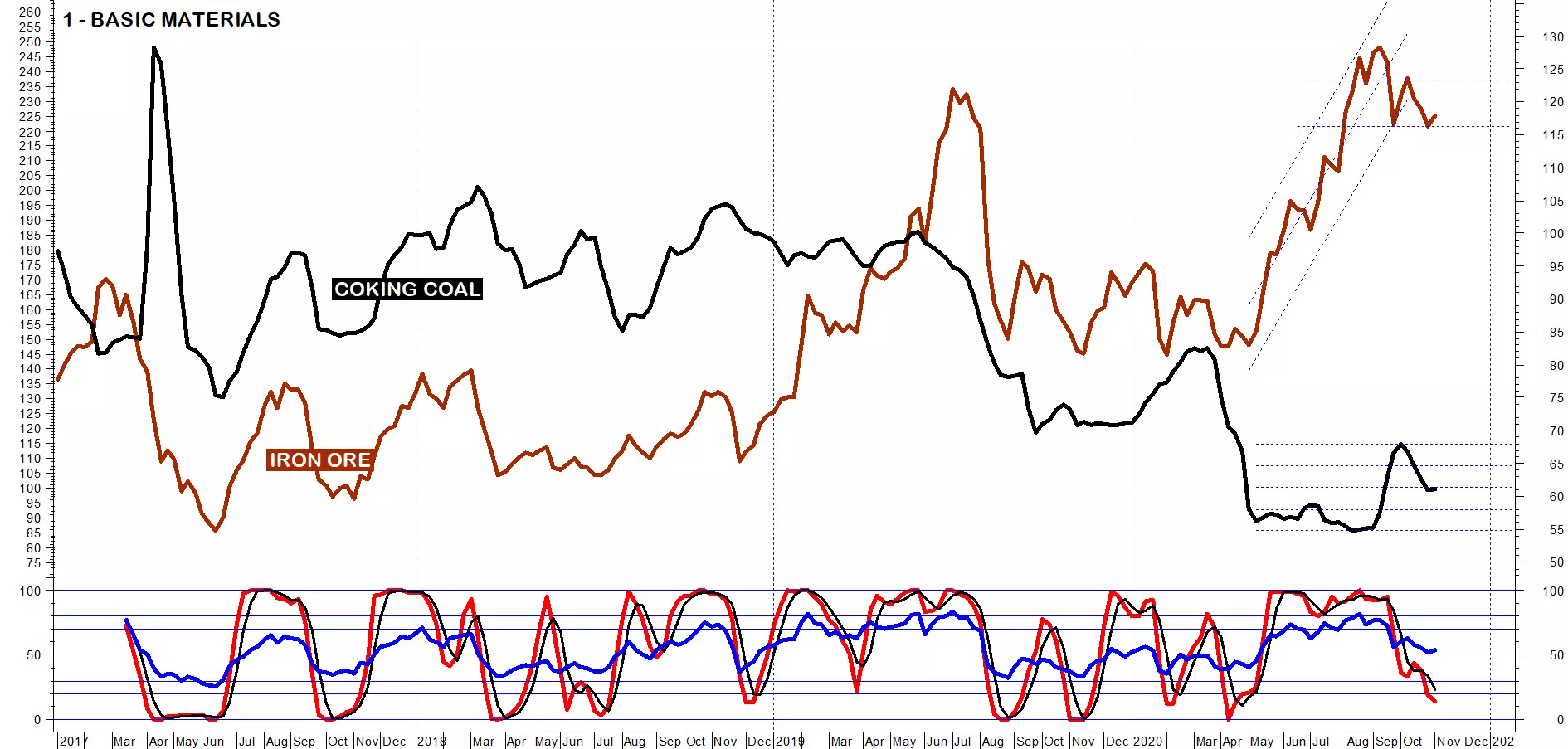

Weekly average prices in US$/ton for iron ore CFR North China (1st picture, scale on the right). A rebound from the minimum values of the end of September (+1,4%) suspends the bending begun in the second week of October, bringing back the curve to fluctuate sideways. Weekly average prices in US$/ton for Carbon Coke FOB Australia (1st picture, scale on the left). Prices are steady to the same levels of the previous week slowing down the drop begun in October: quotations between the minimum of August and the maximum of October foretell the continuation of this adaptation.

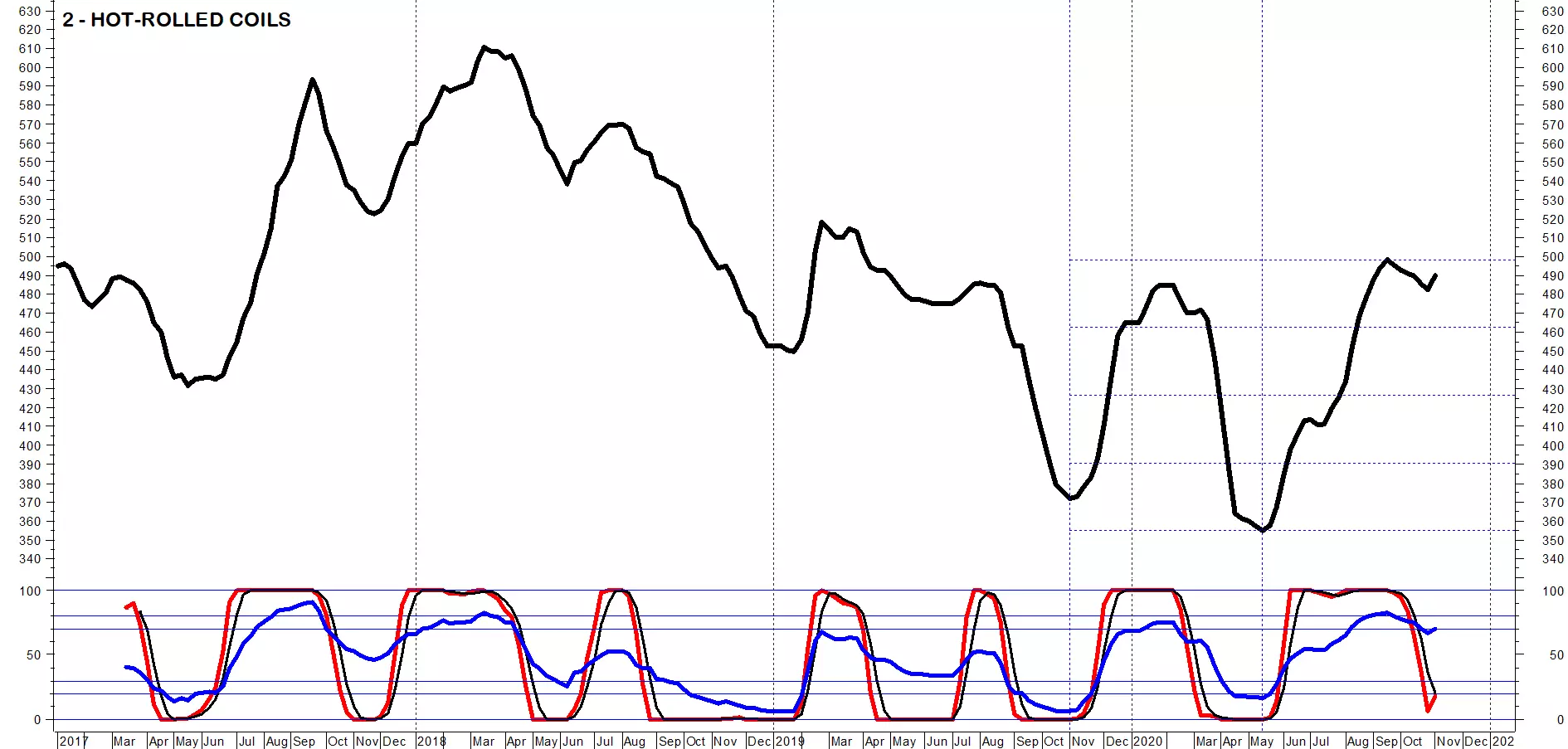

Weekly average prices in US$/ton for Coils FOB Black Sea (2nd picture). As mentioned the last week, a mild recovery (+1,5%) confirms the end of the previous correction. Indicators support the rebound, which goes directly to the maximum of mid-September.

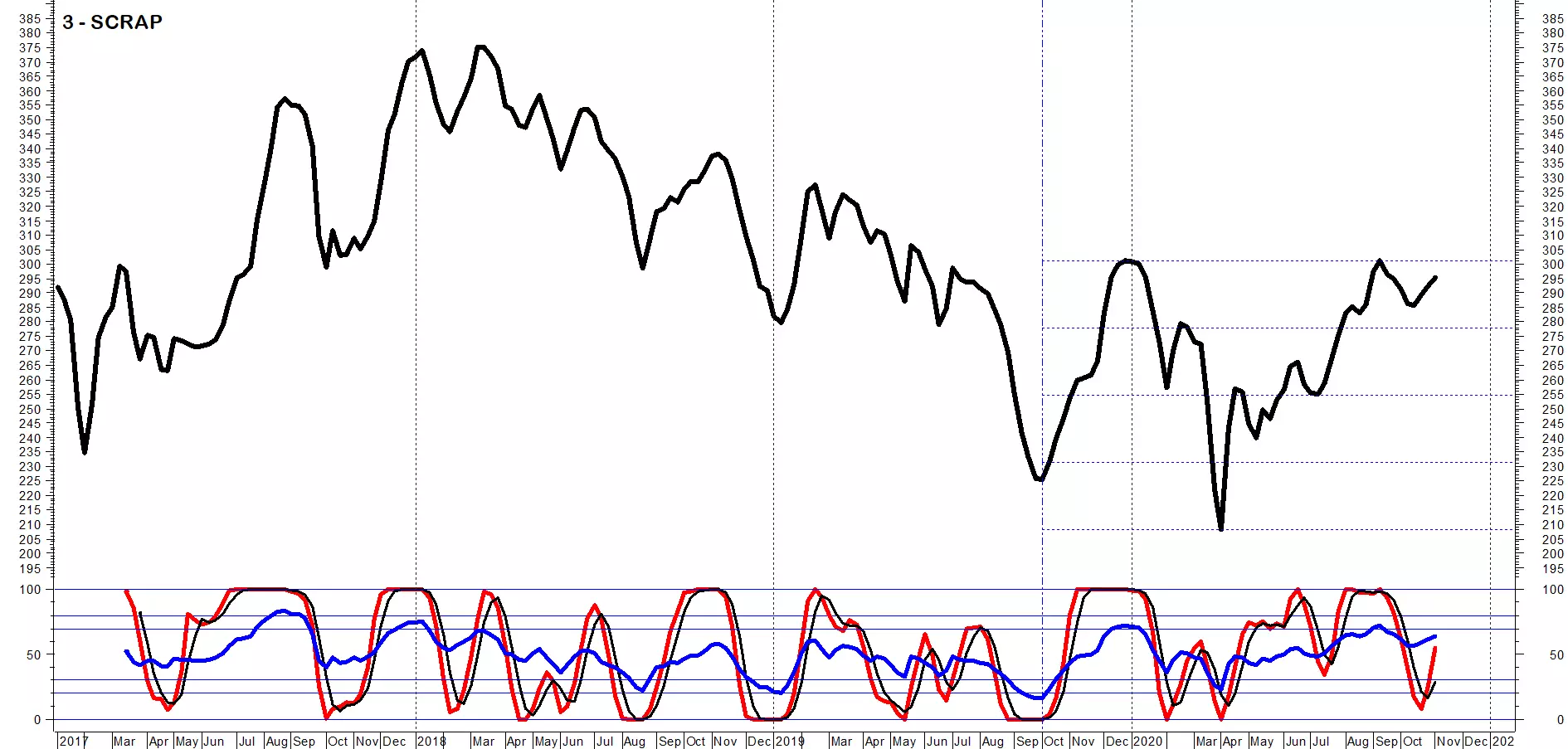

Weekly average prices in US$/ton for Junk CFR Turkey (3rd picture). A new increase (+1%) confirms the awating of the previous week and it extends to +3,3% the growth of prices begun in mid-October. The techniques curves’ position reaffirms further rebound to the maximum of mid-September, coincident with the levels on beginning of the year.

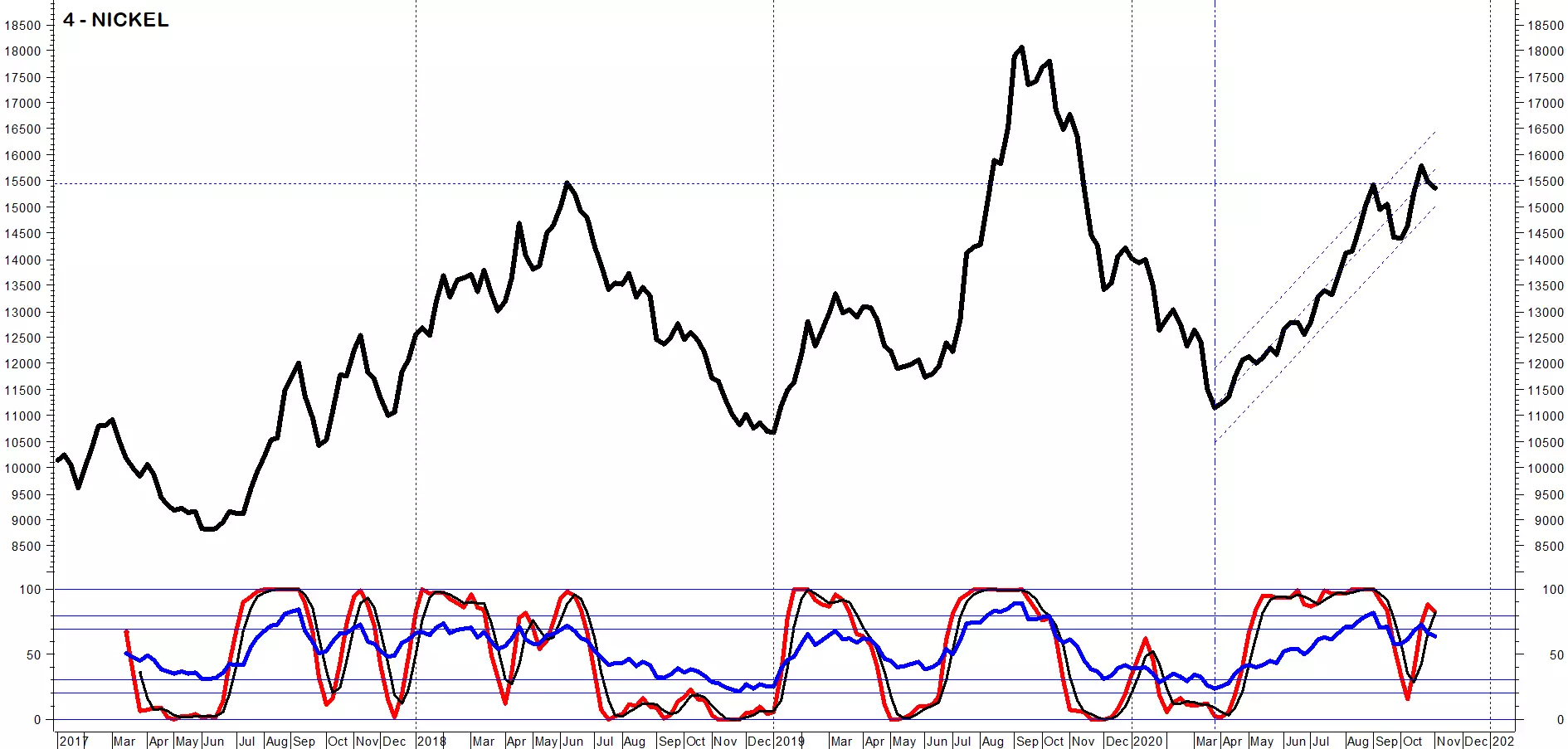

Weekly average prices in US$/ton for Nickel at London Metal Exchange (4th picture). As defined the last week, a further decline (-0,8%) highlights the drop of two weeks ago (-2,7%), pushing the curve in the lower part. Since the technical curves suggest a contraction in volatility, it is probable a mild declining drift towards the support line of the channel.

Weekly average levels of euro-USdollar exchange rate (5th picture). The exchange rate is steady on the same values as the previous week, continuing to develop in the area between the maximum of August and the minimum of September, leaving the ascending channel.

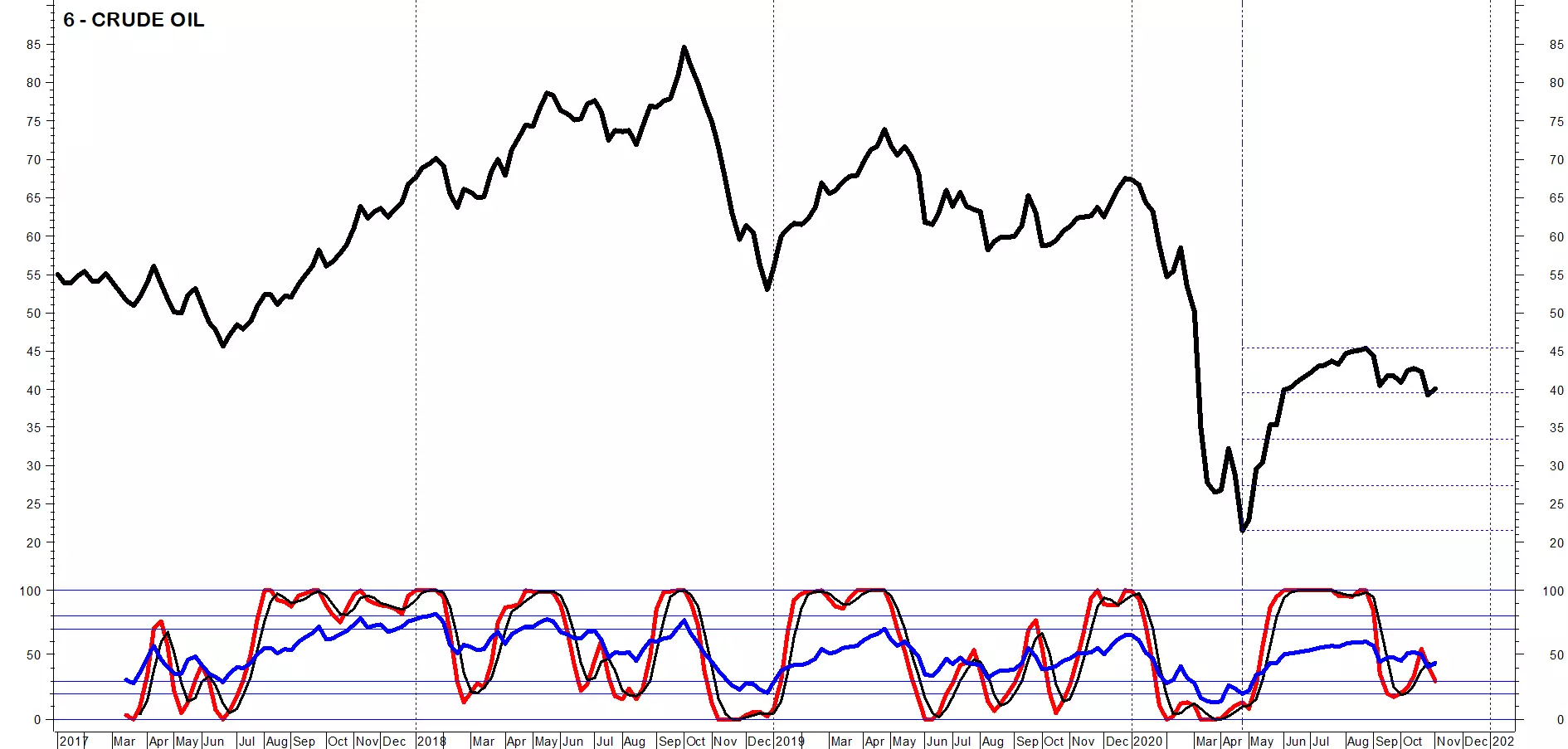

Weekly average prices in US$/barrel of Petroleum (6th picture). A mild recovery (+2,4%) stops the previous bear phase, looking forward to the development to the lateral aisle’s median coincident with the maximum of mid-October.

SOURCE: SIDERWEB.COM